- 0

8 October 2010

Uefa’s Financial Fair Play regulations won’t wipe out the tradition of benefactor involvement in football. They will merely lead to bans from European competition for clubs whose owners want to spend lots of their own money building up those clubs. Those who want to spend freely can do so, but be barred.

It’s a personal point of view that any owner should be allowed to spend their own cash on their own football club, with the proviso that the money is given freely and without conditions, not as loans but as equity, and provides some kind of guarantees of middle-term stability if they walk away. Maybe future funds for a set period could be held in escrow.

On the one hand that still allows benefactor growth (see Blackburn under Jack Walker, Middlesbrough under Steve Gibson, Chelsea, Man City, Wolfsburg, Bayer Leverkusen, Hoffenheim, Zenit and on and on and on). On the other hand it allows some security in the the catastrophic event that the benefactor disappears for some reason, or dies.

It’s easy to argue that Portsmouth went pop, for example, because supposed benefactors turned out not to be. And a more dramatic case of meteoric growth then sudden collapse was seen at Gretna in Scotland. The self-made millionaire Brooks Mileson took the village side from nowhere to the SPL and Europe in a few short years, then his health failed, he withdrew, and then died. And Gretna effectively passed away too.

Brooks Mileson was a good guy, at least in terms of his generosity towards football, and a likeable bloke who I met and interviewed on a number of occasions, as here. But ultimately his demise and that of Gretna showed the dangers of an ownership model where one man or one group pumps in money on an unsustainable basis.

If Roman Abramovich had suddenly become indisposed circa 2004 or 2005, for example, Chelsea would have been in serious trouble, the kind of trouble they were in shortly before he bought them – virtually insolvent. They’re slowly, slowly moving towards sustainability but still too many clubs rely on the largesse of one person. That’s why medium-term, ring-fenced guarantees of some kind are attractive. That’s why I personally have no problem with benefactor funding – as long as such guarantees are in place.

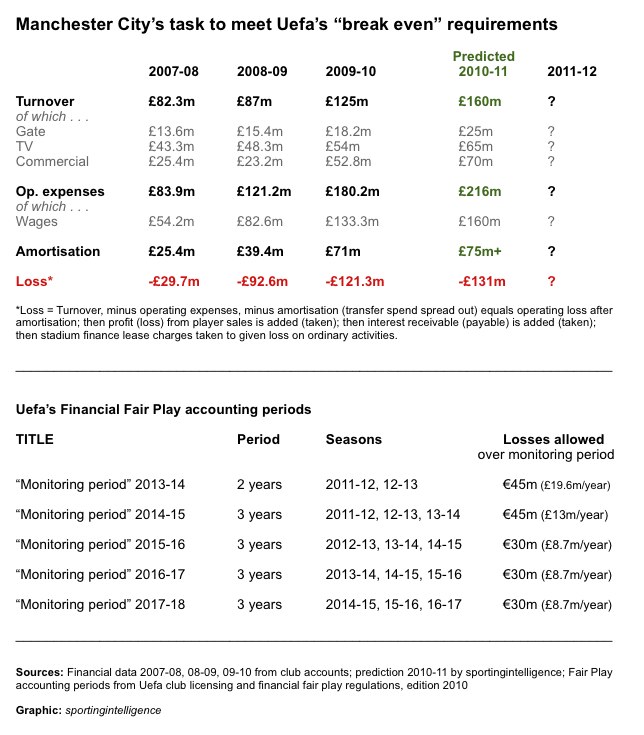

But Uefa does have a problem with it, and the FFP regulations outlaw it aside from in limited amounts in the early years of FFP. And that’s why Manchester City have a problem in the years ahead: because they will need to make some record-breaking leaps in income to have the tiniest prayer of meeting Uefa’s FFP regs. Why? (For a flavour see the table below). And briefly . . .

.

Q: What’s the logic behind FFP?

“The regulations are aimed at bringing about a situation which curbs the excessive spending and inflated transfer fees and player salaries that have endangered football in recent years. They call for greater discipline and more rational financial behaviour from clubs, and encourage clubs to operate more responsibly by not spending more than they earn, while settling their liabilities punctually.

“The measures are designed to protect European football’s long-term health and viability, as well as the integrity and smooth running of the competitions, and also stimulate long-term investment in areas such as youth development and the upgrading of sports installations.”

.

Q: What does it mean in numbers?

A: See the table below for detail but basically from 2011-12, any club with serious long-term ambitions of playing in Europe shouldn’t be losing more than £8.7m per year.

.

Q: And how do City measure up at the moment?

A: Losses of £121m in 2009-10, projected losses of more than that in 2010-11, perhaps £130m, maybe more, and this isn’t just guessing, this is sensibly projected and ratified by people who understands City’s books and spending.

.

Q: How can you be sure of what they’ll make / lose?

A: You can’t be 100 per cent sure because only Sheikh Mansour knows what he’s going to do, but certain income streams are pretty well fixed and predictable, including two of the three main streams: match-day income and TV cash. The only stream with massive flexibility, for now, is commercial income, ie: money from sponsorships and partnerships.

.

Q: And the outgoings?

A: Operating expenses are also fairly predictable (what it costs to run the club on a day-to-day basis) and wages are the biggest part of that. They were £133m in 2009-10 and will be something like £160m in 2010-11. After that, City hope wages will stabilise. It is one of the gambles they’re taking: faith that wages will stabilise and not need to rise to chase on-pitch success.

.

Q: What other gambles are they taking?

A: In short, and in all areas, they’re speculating to accumulate, spending big now on top players transfer fees and massive wage packets in order to try to get success on the pitch that will get them Champions League football and bigger income to pay for those top players and their big wages. They’re also investing heavily in City in general, in facilities, in the local community. All that is laudable but you cannot get away from the fact that the vast majority of the money so far has gone on players and their wages to try to win.

.

Q: So what needs to happen for City to break even, and can they achieve it?

A: They need to earn more than they spend. To do that, they’ll need Champions League football quickly, to boost their income, and on top of that they’ll need huge increased commercial income. A lot of this will probably arrive, from firms in the Middle East wanting a part of Sheikh Mansour’s project. But City need to be careful that they don’t fall foul of Uefa’s “related party” sponsorship rules, which basically outlaw “mates rates” commercial deals. City believe they can steer clear of punitive action on this front, but only time will tell. If they suddenly announce a stadium naming rights deal for £50m a season, for example, it will quickly be pointed out that there is virtually no precedent for big-money naming rights deals on existing stadiums.

.

Q: Any other difficulties?

A: City have c.£250m of unamortised transfer spending to put through their books in the next five years. In laymen’s terms and crudely calculated, they will start every season till 2015 with a £50m red hole in the accounts even before they start because of signings already made. For accounting reasons they cannot get rid of that burden (barring the shipping out of the players who they need to win matches), and if they buy any more players, the burden will only get bigger.

.

Q: How can City make it work, and comply with FFP by 2011-12, when monitoring starts?

A: They say they’ll produce their own players to negate the need to spend on transfers. They say increased income from commercial deals will boost their coffers and help them break even. They hope that Champions League football is around the corner and that it will attract players who are desperate for top-level action and therefore won’t want massive salaries as well. They hope, in short, to make loads of new money and keep costs stable or decrease them. It’s ambitious in a number of senses.

.

Q: Uefa will simply let them off if they fail to comply, surely?

A: Absolutely not, Uefa insist. Rules are rules. There may be a bit of flexibility around the edges, but any serious leeway for individual clubs means the whole system will collapse, and that’s not something Michel Platini wants to allow to happen.

..A

More articles mentioning Manchester City

Sportingintelligence home page

.