- 0

.

UDO ONWERE had a 12-year career as a professional footballer with clubs including Fulham before he hung up his boots and pursued a new career in law. He now works for leading law firm Thomas Eggar on tax and estate planning issues and works extensively within the sports, media and entertainment industries.

.

.

.

.

3 February 2010

Tax rates in Britain are about to rise for high earners and that’s going to force some of them – including some footballers – to leave the country, right? Not necessarily.

In my view, as a lawyer who works in tax, and as someone who had a long career as a professional footballer, it isn’t as simple as that.

From April 2010, the top rate of income tax in the UK will be increased to 50 per cent for individuals earning an income over £150,000 per year. It’s widely assumed that the increase will influence both inward migration (by slowing it) and outward economic migration (quickening it). But this view has to balanced with an element of perspective.

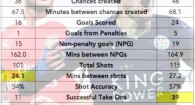

In English football, particularly in the Premier League (PL), it’s evident that the majority of players will be affected. With the average salary somewhere above £1m per year, and some players earning sums reported at £8m per year (£160,000 per week), it doesn’t require mathematical gymnastics to reason that this will provide a healthy return for HMRC (Her Majesty’s Revenue).

But will the tax be a significant factor in deterring the best players – and, therefore, the best paid – from signing for PL clubs and, conversely, encourage players to leave the UK to ply their trade overseas? Maybe not.

First, let’s look at the raw commercial considerations for the PL player faced with an approaching increase in tax. The wealthiest of players will already have professional advice on multiple tax avoidance measures. Many will not be paying the current top rate of 40 per cent income tax, let alone be planning to pay 50 per cent. This advice, whilst expensive, will have enabled the PL player to circumvent and tolerate such a punishing tax climate. Astute advisors are working on all kinds of new schemes too.

One such scheme, mooted already and being considered by some players, could see some clubs paying part of the player’s salary in the form of an interest-free loan. As HMRC only taxes 5 per cent of the amount borrowed, this will greatly reduce the tax charge to the player and will allow the club an opportunity to cancel the loan as and when the tax rate is reduced, which is the assumption (albeit risky) of what would happen, long-term, under a Conservative government. Similar measures have been considered by City bankers determined to escape the government’s “super tax”.

But what if PL teams continue to dominate the Champions League, as they have in recent seasons? These big clubs pay big salaries that probably beat comparable teams’ pay even after higher tax. And the decision is not purely financial, it’s aspirational too. Players may consider the PL to be the footballing centre of the world in the same way that London is promoted as the financial centre. Footballers, like bankers, may conclude the grass is not necessarily greener elsewhere.

On the same theme, I do wonder whether top-earning players really make that much of a distinction between being massively rewarded, and being massively rewarded plus a bit more. It’s my belief that top players are lured as much by the size of a club, its chances of success, its traditions, its reputation and its manager as much as a few extra per cent of pay.

These players will be well remunerated wherever they play; their thoughts may be guided more by career trajectory and the immortality of trophy-winning glory. An inescapable factor for the influx of top players is the passion and excitement of the PL and this influx serves to perpetuate the PL’s global appeal. High taxes or not, this trend may continue.

As more clubs vie to break into the “big four”, and Manchester City and Tottenham are the leaders of the chasing pack for now, so the choices of “big” PL teams will grow, and yet still remain primarily within the “attractive” cities, football-wise, of London, Manchester and Liverpool.

Which leads me to another reason that the PL is attractive in the face of a 50 per cent tax: many foreign players enjoy the cosmopolitan lifestyle and culture that these cities offer. The UK’s elite public educational institutions are also highly respected and valued by many high-earning foreigners who seek such facilities for their children.

Of course, other major cities such as Madrid, Milan and Rome also have similar facilities – not to mention warmer weather! – but they don’t have the natural convenience of the widely-spoken English language. This, I know from my many footballing contacts of different nationalities, is also a persuasive factor for remaining in the UK.

Look at it one other way: not everybody can go and play for Barcelona and Real Madrid. Sure, Spain seems to be the place right now. It has an attractive tax break for foreign players, its national and club teams are European Champions and it employs the three best players in the world in Kaka, Ronaldo and Messi. But it’s most attractive for a tiny elite who can aspire to make it there with the giants; we’re taking a few among thousands.

On the other hand, if the UK’s punitive tax climate really does deter foreign players, to the extent that PL clubs cannot actually match increased wage demands, would it be such a bad thing if clubs were forced, long-term to develop more local talent? It’s a question taxing a few minds at the moment.

.

Udo Onwere works for leading law firm Thomas Eggar LLP, and is part of the Sport & Media team, which includes former professionals from both environments and is able to field technically excellent lawyers in this field.