- 0

By Nick Harris

8 October 2010

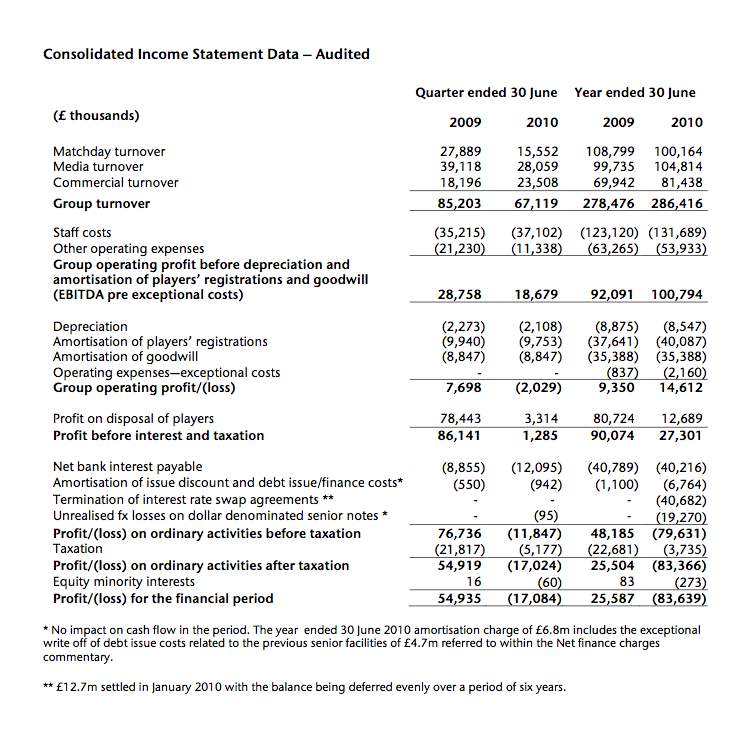

Manchester United made a record operating profit of £100.8m in 2009-10 but today posted overall losses of £83.64m (£79.63m loss on ordinary activities before taxation).

The balance sheet is below.

The turning of impressive profits into losses that will rattle many United fans can be explained through interest payments on debt placed on the club by the Glazer family, by exceptional (and not exceptional) charges relating to refinancing of debt, by currency fluctuations and by accounting practices.

All of the above will fuel intense and heated debate about the state of the club.

From the ownership and management the message will be: “We’re in good shape, we make lots of money and we have a pile of cash in the bank.” And these sentiments are backable with hard numbers.

From some fans’ point of view, the message will be: “The owners have saddled the club with huge debts now being paid off effectively by fans, and that pile of cash in the bank is inevitably going to be used to pay of the owners’ (separate) private PIK debts.” Again, sincerely held views that are backable partly by numbers and highly likely to be true.

The club debt is £521.7m; the Glazers then owe PIK debt (interest %16.25 pa) of about £220m.

To try to make some sense of the numbers:

- £286.416m = income in 2009-10 from matchday (£100m), media (£105m) and commercial deals (£81m).

- £131.689m = staff costs including player wages, plus £53.9m in other operating costs, equals £185.6m total costs.

- £100.794m is operating profit.

.

- £40m on amortisation of players is a normal expense and with that alone deducted from operating profit along with depreciation and exceptional operating costs (£8.5m + £2m), that would ordinarily leave a c.£50m overall profit, boosted again by profit on player sales (£12.7m).

- But then lop off bank interest (£40m) swap loss (£40.7m on refinancing which won’t re-occur), currency fluctuation loss (£19.2m, which might be loss again, or profit, in future, depending on the £/$ rates), and that’s £100m of red ink in those three items alone.

- Further, United count a balance sheet figure of £35.4m loss each year for “amortisation of goodwill”, which is basically an accounting practice to reflect the money they originally paid for the club spread over 15 years, not “real” expenditure.

The detail is all below. On another page, the accounts show £163.8m in cash, sitting in the bank. It’s widely expected at some stage that the Glazers will dip into that to pay off the PIK. In one sense that’s entirely sensible, to clear this “timebomb” debt that the club insists has nothing to do with MUFC.

On the other hand, some fans will argue that the club’s hard earned cash is being used to fund the Glazers’ buyout. Just because that’s a five-year-old story doesn’t make many of those fans any less irate. The Glazers have been using United itself to fund their own purchase of United for five years; that’s the LBO model, normal to businessmen, abhorred by most in football.

As far as meeting Uefa’s Financial Fair Play commitments goes, enough of United’s paper losses are just that – and not counted in FFP small print – that they feel they will meet the FFP rules easily. Why? They make more money than they actually spend.

.

More stories mentioning Manchester United